Trump Family Bitcoin Holdings Surge to $415M Milestone

The Trump family’s involvement in cryptocurrency takes a significant step forward as American Bitcoin, backed by Eric Trump and Donald Trump Jr., announces its Bitcoin holdings have reached 4,004 BTC, valued at approximately $415 million. This surge comes after acquiring 139 additional Bitcoins between October 24 and November 5, worth over $14 million. The move underscores the growing intersection of politics and finance in the crypto space.

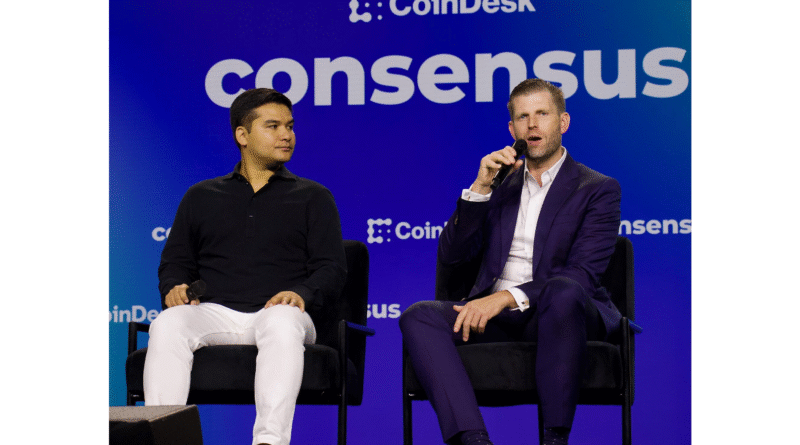

Eric Trump, co-founder and Chief Strategy Officer of American Bitcoin, emphasized the company’s dual strategy of scaled Bitcoin mining and disciplined market purchases to expand holdings cost-effectively. This approach positions the firm as the 25th largest Bitcoin treasury globally, according to bitcointreasuries.net. As Bitcoin trades around $103,369, up 3% in the last 24 hours but down 18% from its October peak above $126,000, such accumulations highlight strategic confidence amid market fluctuations.

American Bitcoin emerged from a merger earlier this year between the Trump brothers’ business entity and Hut 8, a Canada-based miner. This joint venture further combined with publicly traded Gryphon Digital Mining through a stock-for-stock deal. The Nasdaq-listed company (ABTC) saw its stock rise nearly 2% on Friday, recovering from an earlier dip, reflecting investor interest in its Trump-backed operations.

Background on American Bitcoin’s Formation

The formation of American Bitcoin marks a pivotal moment for the Trump family in the cryptocurrency arena. By merging with established players like Hut 8 and Gryphon, the company leverages existing infrastructure for Bitcoin mining while building a substantial treasury. This Trump family Bitcoin initiative aligns with broader trends where public companies, inspired by Strategy (formerly MicroStrategy), amass Bitcoin to enhance shareholder value.

Strategy pioneered this model in 2020, pivoting from software to Bitcoin accumulation, now holding over 641,000 BTC worth more than $66 billion. American Bitcoin follows suit, becoming one of over 200 publicly traded firms adopting similar strategies. A Myriad prediction market shows 95% of respondents expect Strategy to hold its BTC through 2025, indicating long-term commitment in the sector.

The Trump family Bitcoin push comes at a time when the mining industry faces challenges. Bitcoin’s 2024 halving reduced rewards from 6.25 to 3.125 BTC per block, making operations less lucrative. Many miners are diversifying into AI computing for high-powered needs, but American Bitcoin remains focused on crypto, betting on Bitcoin’s future value.

Impact of the Halving on Mining Operations

The halving event, occurring roughly every four years, slows Bitcoin’s supply issuance to mimic scarcity like gold. For miners, it halves revenue from block rewards, intensifying competition and pushing inefficient operations out. American Bitcoin’s strategy mitigates this by balancing mining with direct purchases, ensuring steady growth in holdings despite reduced rewards.

Experts note that post-halving, only the most efficient miners survive, those with access to cheap energy and advanced hardware. Hut 8’s involvement provides American Bitcoin with such advantages, including plans to boost energy capacity as highlighted in recent Benchmark analyses. This positions the Trump family Bitcoin venture to thrive in a consolidating industry.

Broader Implications for Crypto and Politics

This expansion by American Bitcoin highlights the deepening ties between cryptocurrency and political figures. With Donald Trump as President-elect, speculation grows about pro-crypto policies that could benefit such ventures. The Trump family Bitcoin holdings not only represent financial ambition but also potential influence on U.S. crypto regulation.

For investors, this development signals optimism in Bitcoin’s long-term prospects. Despite recent price dips, accumulations by high-profile entities like American Bitcoin suggest belief in recovery and growth. This follows recent Bitcoin price fluctuations, where the asset dipped to $103,000 after a rally slump.

Stakeholders in the crypto community view the Trump involvement positively, potentially attracting more institutional interest. However, it raises questions about conflicts of interest, given the family’s political prominence. Regulators may scrutinize such holdings to ensure transparency and prevent undue influence on policy.

Expert Opinions on Trump Family’s Crypto Strategy

Analysts from firms like Benchmark praise American Bitcoin’s approach, raising price targets for Hut 8 due to energy expansions. Crypto experts, including those from Decrypt, note that the Trump brothers’ backing adds legitimacy and visibility to mining operations. One insider commented, “This could accelerate mainstream adoption, blending family legacy with digital innovation.”

Academics in finance highlight the risks: Bitcoin’s volatility could impact stock performance, as seen in ABTC’s seesaw trading. Yet, the strategy mirrors successful models like Strategy’s, which turned Bitcoin into a treasury asset yielding superior returns over traditional investments.

Government officials remain cautious, emphasizing that crypto firms must comply with securities laws. As the Trump family Bitcoin empire grows, calls for clearer regulations intensify, potentially shaping the 2025 legislative landscape.

Comparison to Industry Peers

Compared to peers, American Bitcoin’s $415 million treasury ranks modestly but shows rapid growth. Strategy leads with $66 billion, but its scale comes from years of accumulation since 2020. Other miners like Marathon Digital and Riot Blockchain hold billions but face similar halving pressures.

The Trump family Bitcoin play differentiates through its political branding, potentially drawing unique partnerships. This echoes Trump’s broader Bitcoin reserve proposal for a $100 billion national stockpile, which could synergize with private ventures like American Bitcoin.

In terms of stock performance, ABTC’s 2% gain Friday contrasts with Nasdaq’s slight dip, outperforming in a volatile session. This resilience stems from the firm’s diversified revenue from mining and holdings, unlike pure miners struggling post-halving.

Historical Context of Corporate Bitcoin Adoption

Corporate Bitcoin adoption began accelerating in 2020, with Tesla’s $1.5 billion purchase sparking a trend. Today, over 200 firms hold BTC, treating it as a hedge against inflation. The Trump family Bitcoin entry fits this narrative, especially amid global economic uncertainties like inflation and geopolitical tensions.

Precedents show mixed results: While Strategy’s stock soared 500% since pivoting, others like Tesla sold portions during dips. American Bitcoin’s commitment to holding, as per market predictions, aligns with HODL strategies popular in crypto circles.

Future Outlook and What to Watch

Looking ahead, American Bitcoin plans further expansions, potentially through more mergers or energy investments. With Bitcoin’s next halving in 2028, efficiency will be key. The Trump family Bitcoin holdings could reach $500 million by mid-2025 if prices rebound to $120,000.

Investors should monitor regulatory developments, especially under a Trump administration favoring deregulation. Positive policy shifts could boost mining profitability, benefiting ABTC stock. Conversely, market downturns might pressure holdings’ value.

For the broader economy, this Trump family Bitcoin move could inspire more family offices and politicians to enter crypto, democratizing access. However, it underscores the need for education on risks, as Bitcoin remains speculative.

As this story evolves, it ties into ongoing crypto redemption narratives like Bankman-Fried’s appeal, highlighting the sector’s dynamic interplay with politics.

Practical Takeaways for Investors

For everyday investors, American Bitcoin’s success story offers lessons: Diversify strategies like mining plus buying, focus on long-term holding, and stay informed on halvings’ impacts. Beginners might consider Bitcoin ETFs for exposure without direct mining risks.

Stakeholder perspectives vary: Crypto enthusiasts celebrate the Trump endorsement, while skeptics warn of politicization. Customers of mining services benefit from Hut 8’s infrastructure, but environmental concerns over energy use persist.

In summary, the Trump family Bitcoin surge to $415 million marks a milestone, blending family enterprise with crypto innovation. As the industry matures, such ventures will shape finance’s future.

For readers interested in the fundamentals of cryptocurrency, exploring stock market basics provides a solid foundation for understanding Bitcoin’s role in portfolios. Those new to investing can benefit from index fund strategies that include crypto exposure. To grasp broader market dynamics, check out saving vs. investing guides for balanced approaches. Finally, for debt-free paths toward crypto investments, review debt payoff tactics to free up capital.

Source: Yahoo Finance