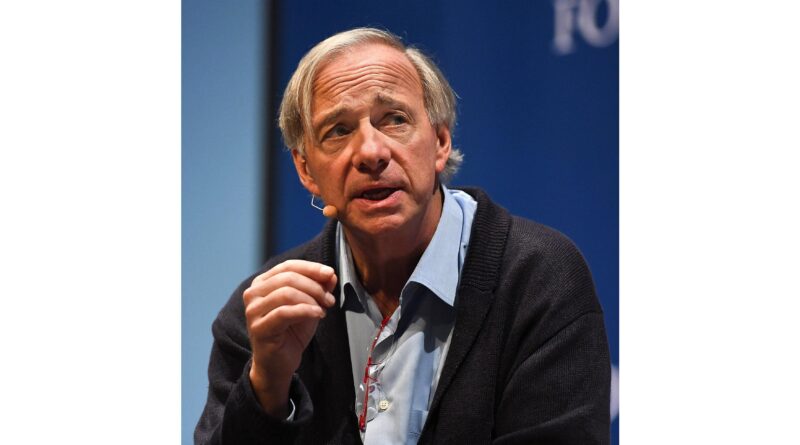

Fed Policy Warning: Ray Dalio Signals Inflation Risks in AI Era

Renowned investor Ray Dalio has issued a fresh Fed policy warning, cautioning that the Federal Reserve’s latest moves toward increased quantitative easing (QE) could ignite inflationary pressures while boosting certain asset classes. This comes at a time when AI-driven growth is reshaping the economy, making Dalio’s insights particularly timely for investors navigating volatile markets.

Dalio, the founder of Bridgewater Associates, shared his concerns in a recent analysis, pointing to the unique economic environment shaped by aggressive fiscal, monetary, and regulatory policies. He argues that this ‘bold and dangerous big bet on growth, especially AI growth,’ financed through liberal looseness, demands close monitoring to avoid pitfalls.

Understanding the Fed’s New Policy Shift

The Federal Reserve’s decision to ramp up QE aims to lower real interest rates and inject liquidity into the financial system. By compressing risk premia, this policy pushes down real yields and elevates price-to-earnings (P/E) multiples, particularly benefiting long-duration assets like tech stocks and AI companies.

Dalio explains that, all else equal, such measures should favor inflation hedges like gold and inflation-indexed bonds. Tangible asset companies in mining, infrastructure, and real assets may outperform pure long-duration tech once inflation risks materialize.

This Fed policy warning underscores how the central bank’s actions differ from past stimulus episodes. Dalio provided a table contrasting historical data, noting that today’s scenario appears more inflationary and risky due to the scale of commitments in AI infrastructure.

Key Elements of the QE Expansion

Quantitative easing involves the Fed purchasing large quantities of securities to increase money supply. In this case, it’s designed to support economic expansion amid slowing growth signals. However, Dalio warns that the interplay with fiscal stimulus and deregulatory efforts could amplify inflationary outcomes.

Experts echo this Fed policy warning. Economists at major banks like JPMorgan note that while QE provides short-term relief, prolonged use risks eroding purchasing power. The policy’s focus on AI growth financing—through cheaper loans for data centers—exemplifies the high-stakes gamble.

For everyday investors, this means reassessing portfolio allocations. Traditional safe havens like U.S. Treasuries may yield less appeal if inflation surges, pushing capital toward commodities and diversified assets.

Why This Fed Policy Warning Matters Now

The timing of Dalio’s Fed policy warning coincides with market jitters over AI valuations. Recent surges in tech stocks, driven by companies like Nvidia and OpenAI, have raised bubble concerns. Dalio’s analysis suggests that Fed actions could extend this rally but at the cost of future stability.

Inflation data shows consumer prices rising steadily, with core PCE at 2.8% year-over-year. The Fed’s QE could exacerbate this if supply chains remain strained from global tensions. Dalio emphasizes that the policy’s inflationary tilt might hit middle-income households hardest, eroding savings gains.

Stakeholders from Wall Street to Main Street are reacting. Tech executives praise the liquidity boost for innovation, while consumer advocates worry about rising costs for essentials like energy and housing.

Historical Context and Precedents

Looking back, post-2008 QE rounds spurred recovery but also asset bubbles. Dalio recalls the 2020-2022 period, where massive stimulus fueled stock highs alongside inflation spikes. Today’s Fed policy warning draws parallels, but with AI as the new growth engine, the dynamics are amplified.

Comparisons to Japan’s lost decade highlight risks of prolonged low rates. Dalio’s table illustrates how current stimulus levels exceed prior episodes in scale, potentially leading to a more volatile unwind.

Analysts at Bridgewater project that without careful navigation, this could trigger a shift from growth stocks to value plays. Investors should watch Fed meetings for signals on tapering QE.

Expert Opinions on the Fed’s Direction

Ray Dalio isn’t alone in his Fed policy warning. Former Fed Chair Janet Yellen has voiced concerns about balancing growth with price stability. Current Chair Jerome Powell acknowledges inflation risks but prioritizes employment data.

Industry insiders like Jamie Dimon of JPMorgan warn that loose policy could overheat sectors like real estate. Academics from Harvard Business School point to AI’s energy demands as a wildcard, potentially straining resources and driving up costs.

Dalio’s perspective, shaped by decades of market cycles, carries weight. He advises diversification into real assets, echoing views from Warren Buffett on hedging against policy missteps.

Stakeholder Perspectives

Customers and voters feel the pinch through higher borrowing costs despite low rates. Small business owners benefit from easier credit but fear input price hikes. Fans of AI optimism, including venture capitalists, see QE as fuel for innovation hubs.

Affected communities in mining regions could thrive if tangible assets rally, but urban tech centers might face talent retention issues amid economic uncertainty.

This multifaceted Fed policy warning highlights the policy’s broad ripple effects, from Silicon Valley boardrooms to Midwest factories.

Background on Key Players: Ray Dalio and the Fed

Ray Dalio built Bridgewater into the world’s largest hedge fund, renowned for macroeconomic bets. His book ‘Principles’ outlines risk management in uncertain times, directly informing his current Fed policy warning.

The Federal Reserve, under Powell, juggles dual mandates of price stability and maximum employment. Recent minutes reveal debates on QE’s role in supporting AI-driven productivity without overheating.

Related entities like the Treasury Department coordinate with the Fed, influencing fiscal responses. Dalio’s interactions with policymakers underscore his influential voice in these discussions.

Policy Comparisons

Compared to ECB or Bank of Japan’s approaches, the Fed’s QE is more aggressive, tailored to U.S. innovation strengths. However, emerging markets warn of currency volatility spillover.

Dalio contrasts this with 2010s policies, noting today’s AI focus adds a tech layer absent before.

Investors can learn from these variances: U.S.-centric portfolios may need global buffers.

Broader Implications for Markets and Economy

Dalio’s Fed policy warning signals potential shifts in asset performance. Long-duration tech could soar initially, but inflation might pivot capital to gold, up 15% YTD, and infrastructure plays.

For the global economy, higher U.S. yields could strengthen the dollar, pressuring exporters. AI investments, projected at $1 trillion by 2030, amplify these effects.

Communities reliant on tech jobs face uncertainty if valuations correct. Conversely, renewable energy sectors might benefit from policy tailwinds.

This policy’s impact extends to everyday life: higher inflation could raise grocery bills by 5-7%, per recent forecasts.

Recent Developments in Fed Policy

The Fed’s September meeting hinted at QE resumption amid softening labor data. Unemployment at 4.1% prompts action, but CPI persistence tempers cuts.

Dalio’s timely intervention follows market dips, with Nasdaq down 2% last week on AI bubble fears. This follows OpenAI’s revenue surge, highlighting policy’s role in funding such growth.

Similar to Trump tariffs scrutiny, Fed moves face legal and market tests.

As reported in housing recession warnings, policy delays affect sectors broadly.

Future Outlook: What to Watch For

Looking ahead, Dalio predicts monitoring inflation metrics closely. A CPI above 3% could force Fed pivots, impacting bonds and equities.

AI’s trajectory remains key: if productivity gains materialize, policy support might sustain growth. Otherwise, a correction looms.

Practical lessons include stress-testing portfolios against 5% inflation scenarios. Diversify into TIPS and commodities for resilience.

Next Steps for Investors

Rebalance toward balanced funds. Track FOMC announcements for QE details. Dalio recommends all-weather strategies blending growth and defense.

What happens next depends on data: strong jobs reports could delay easing, intensifying the Fed policy warning.

For readers navigating this, understanding fundamentals helps contextualize risks.

Related Resources for Deeper Insight

To grasp saving vs investing basics amid policy shifts provides a solid foundation.

Investors benefit from proven investment strategies that hedge inflation.

Explore how interest rates work to anticipate Fed impacts.

Source: MarketWatch