Debt Free Journey: Your Ultimate 12-Month Roadmap to Lasting Financial Independence

Embarking on a debt free journey can transform your financial life, offering relief from constant payments and opening doors to wealth building. Many people feel overwhelmed by mounting debts from credit cards, loans, or unexpected expenses, but with a structured 12-month action plan, you can systematically pay off what you owe and emerge stronger. This roadmap focuses on practical strategies tailored for 2025’s economic landscape, including rising interest rates and inflation pressures. Whether you’re starting with high-interest credit card balances or student loans, committing to this plan will guide you toward financial independence.

Table of Contents

Understanding the Foundations of Your Debt Free Journey

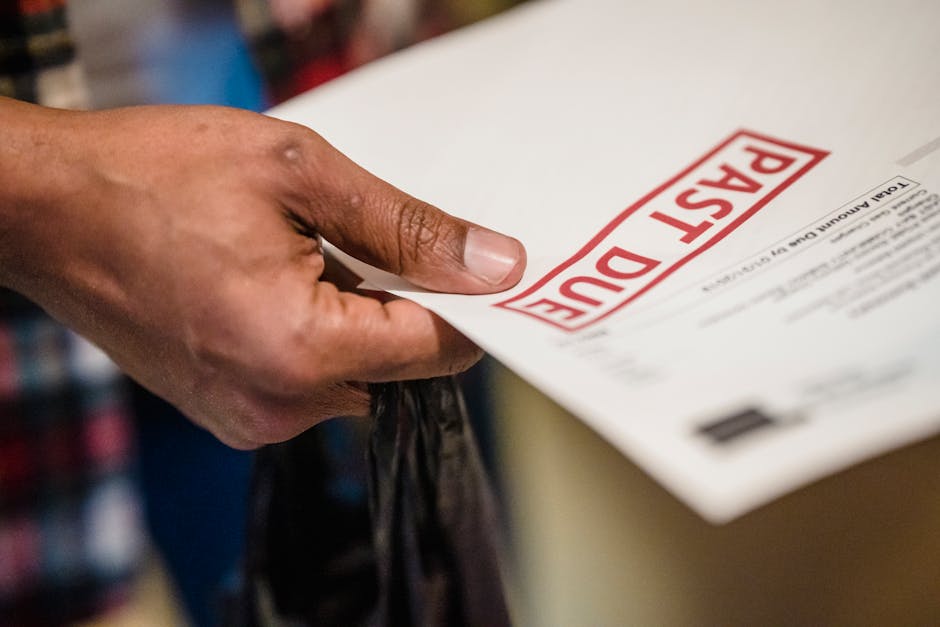

A debt free journey begins with a clear understanding of your current financial situation. High-interest debts like credit cards can accrue thousands in fees annually, trapping you in a cycle of minimum payments. According to financial experts, the average American household carries over $100,000 in debt, making this journey essential for long-term stability.

To start, calculate your total debt across all sources. List credit cards, personal loans, auto loans, and any mortgages. Prioritize based on interest rates—high-APR debts should top the list. This assessment sets the stage for your 12-month plan, ensuring every step aligns with your goals.

Why embark on this debt free journey now? In 2025, with potential Federal Reserve rate adjustments, locking in lower payments early can save significant money. Building an emergency fund alongside debt reduction prevents future borrowing. Remember, consistency is key; small daily choices compound into major wins.

Financial literacy plays a crucial role here. Educate yourself on terms like APR and debt-to-income ratio. Resources from trusted authorities can demystify these concepts, empowering you to make informed decisions throughout your journey.

Months 1-3: Assessing and Planning Your Path Forward

The first quarter of your debt free journey focuses on evaluation and groundwork. Begin by tracking every expense for one month using a simple budgeting app or spreadsheet. Categorize spending into essentials like housing and food, versus discretionary items such as dining out.

Create a realistic budget that allocates 50% to needs, 30% to wants, and 20% to savings and debt payoff. This framework, often called the 50/30/20 rule, helps identify leaks in your finances. For instance, cutting cable TV could free up $100 monthly for debt payments.

Next, choose a debt repayment method. The debt snowball method pays off smallest balances first for quick wins, boosting motivation. Alternatively, the debt avalanche targets highest interest rates to minimize costs. Whichever you select, commit to it fully during these initial months.

Build a starter emergency fund of $1,000 to cover surprises without derailing your plan. Open a high-yield savings account for this purpose, aiming for at least 4% APY in 2025. Automate transfers from your paycheck to ensure steady progress.

Review your credit report for errors that could inflate rates. Dispute inaccuracies promptly to potentially lower borrowing costs. This phase solidifies your debt free journey foundation, setting a tone of discipline and awareness.

Incorporate side income streams early. Freelancing or gig work can add $200-500 monthly, accelerating your payoff. Track progress weekly to stay motivated, celebrating milestones like closing one account.

Months 4-6: Implementing Debt Payoff Tactics

With foundations laid, months 4 through 6 ramp up action in your debt free journey. Negotiate with creditors for lower rates or hardship programs, especially if rates exceed 20%. Many lenders offer temporary relief, reducing minimums and interest.

Consider debt consolidation if you have multiple high-interest accounts. A personal loan at 10-15% APR can simplify payments and cut overall costs. Compare options from credit unions or online lenders for the best terms in 2025.

Balance transfer cards with 0% introductory APR provide breathing room. Transfer balances to avoid interest for 12-18 months, but watch transfer fees around 3-5%. Use this tactic strategically to pay principal aggressively.

Increase payments by 10-20% above minimums, directing extras to your priority debt. If using the avalanche method, this could shave years off repayment timelines. Track savings with a debt payoff calculator to visualize impact.

Address lifestyle inflation by reviewing habits. Opt for home-cooked meals over takeout, saving $300 monthly. Redirect these funds directly to debt, maintaining momentum in your debt free journey.

Monitor credit utilization, keeping it under 30% to boost your score. This improves future borrowing power if needed, though the goal is to avoid new debt entirely. Consult a non-profit credit counselor if overwhelmed, ensuring ethical guidance.

By mid-year, aim to eliminate at least one debt source. This tangible progress reinforces commitment, making the remaining journey feel achievable. Adjust your budget as income or expenses shift, staying flexible yet focused.

Months 7-9: Building Momentum and Habits

Entering the second half of your debt free journey, leverage momentum from early wins. With fewer payments, redirect freed-up cash to remaining balances. For example, after paying off a $5,000 card, apply that monthly $200 elsewhere.

Strengthen financial habits by automating all bill payments and savings. This prevents late fees, which average $40 each and add unnecessary debt. Set alerts for account balances to avoid overdrafts.

Explore income boosts like negotiating a raise or starting a side hustle. In 2025, remote gigs in writing or tutoring offer flexible earnings. Dedicate 50% of extra income to debt, the rest to your emergency fund.

Reassess your budget quarterly, incorporating any economic changes like inflation. Adjust for rising costs in groceries or utilities, ensuring debt payments remain priority. This adaptability keeps your debt free journey on track.

Build credit health by becoming an authorized user on a family member’s well-managed card, if appropriate. Or, use a secured card responsibly to demonstrate positive history. Aim for a 700+ score by journey’s end.

Avoid common pitfalls like new purchases on cleared cards. Treat them as closed mentally, focusing on cash-only living where possible. This discipline cements habits for post-debt life.

Share your progress with a trusted friend for accountability. Joining online communities for debt free journeys provides support and tips from peers facing similar challenges.

Months 10-12: Securing Your Debt Free Future

The final quarter solidifies your debt free journey achievements. With most debts cleared, intensify efforts on any stragglers like student loans. Explore income-driven repayment plans if applicable, aligning payments with earnings.

Grow your emergency fund to 3-6 months of expenses, parking it in a high-yield account. This buffer protects against setbacks, allowing focus on wealth building post-debt.

Plan for taxes on any forgiven debt, consulting IRS guidelines. In 2025, certain relief programs may exclude amounts from taxable income, but verify your situation.

Transition to investing basics once debt-free. Start with a Roth IRA or 401(k) contributions, especially if employer-matched. This shifts your focus from payoff to growth in your debt free journey.

Reflect on lessons learned, journaling successes and challenges. This reflection aids in maintaining frugality and smart spending long-term.

Celebrate your debt free status responsibly—perhaps a modest dinner out. More importantly, set new goals like homeownership or retirement savings. Your 12-month action plan has equipped you for sustained financial independence.

In conclusion, this debt free journey demands dedication but yields profound rewards. From reduced stress to increased net worth, the benefits extend far beyond numbers. Stay vigilant, and your financial future will thrive.

For more on accelerating credit card payoffs, check out our guide on how to pay off credit card debt fast. If considering investments next, read about saving vs investing in 2025. For student debt specifics, explore student loan forgiveness programs 2025.

Learn more from the Consumer Financial Protection Bureau on debt management best practices.